Save on personal property taxes

Published 11:01 am Thursday, February 11, 2016

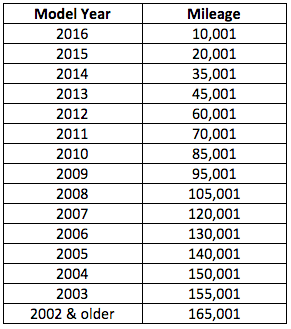

A passenger vehicle assessment may be reduced if the vehicle has high mileage, according to the Lunenburg County Commissioner of the Revenue’s office. “The reduction is based on actual mileage as of Jan. 1. The following chart indicates the minimum mileage necessary to qualify for high mileage reduction,” according to a release.

To apply for high mileage reduction, please provide the office with the following information:

1. A copy of the 2015 vehicle state inspection or a service work order documenting the mileage.

2. Current mileage for vehicle (include year and make).

This information is due to the commissioner by March 2.

“If you have any changes to your personal property, contact the office at (434) 696-2516 to ensure that account information is accurate.”

Below are mileages that qualify.